Meyers Brothers Kalicka, P.C. Announces New Dynamic Website, Loaded with Helpful Resources

Meyers Brothers Kalicka, P.C. Announces New Dynamic Website, Loaded with Helpful Resources

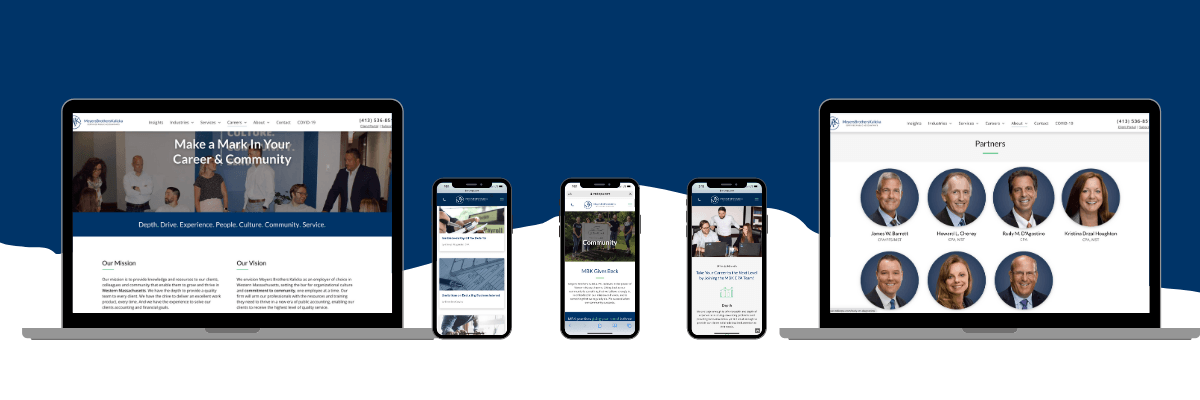

Rooted in a history of excellence and propelled by a fresh mission and vision, the firm is proud to announce its new website.

The primary goal during the redesign process was to create a more user-friendly and valuable resource for our clients and community alike. More specifically, we wanted our users to easily locate information about accounting services, industries we serve, our firm, our team, and our community.

MBK’s recent rebrand extends beyond a new style guide, logo and aesthetic to include key concepts which the website reflects upon: Depth. Drive. Experience. We have the depth to provide a quality team to every client. We have the drive to deliver an excellent work product, every time. And we have the experience to solve our clients' accounting and financial goals.

“Over the past few years, MBK has undertaken a significant transformation with a brand new mission and vision statement. One of the ways that we are building on our tradition of excellence is by becoming a better online resource and authority for our clients and community. By updating our website, increasing our blog activity and having a consistent presence on social media, we are making ourselves and our knowledge more accessible to others.” – James T. Krupienski, CPA and Partner at Meyers Brothers Kalicka, P.C.

Sharing Our Knowledge

MBK’s new website features an active blog with articles about taxation, accounting, advisory, news and community. Additionally, the firm offers free newsletters centered around Taxation, Business, Not-For-Profits and Healthcare. These newsletters help you to stay informed on recent provisions and guidance, access articles, get invitations to special webinars or podcasts, and gain industry knowledge. You can subscribe to any or all of these newsletters for free by adding your email address into the subscribe feature located in the footer of our new website.

Highlights on www.mbkcpa.com

- Real People. Real Stories. Real Results.

Testimonials from real clients are featured throughout the site. - Our Story

A deep dive into what MBK is really all about. Where we stared, where we are going, who we are, what we do, and distinguishing features. - The Team

Our advisors are the heartbeat of our organization. All team members are highlighted on a dedicated page and throughout the Careers and Community pages. - Careers

“We envision Meyers Brothers Kalicka as an employer of choice in Western Massachusetts, setting the bar for organizational culture and commitment to community.” Visit the Careers page for more information on what it is like to work at MBK and current career opportunities. - Community

Learn about the three ways that MBK is giving back to our community year-round, and how to get involved or seek support from our team. - COVID-19

More than updates on our operations, you will find articles, insights, and invitations to online events discussing important financial topics surrounding the pandemic. - Client Portal

Clients can login to send and receive encrypted files, protecting your information. - Connect

MBK is active on Facebook, Instagram, Twitter and LinkedIn: @mbkcpa. You can also send us a message through the site, click to call or simply get our contact information.

Meyers Brothers Kalicka, P.C. is the largest independent and locally owned and operated CPA firm in Western Massachusetts. Based in Holyoke Massachusetts, the firm is comprised of approximately 50 professionals and administrative staff, including six partners. As members of CPAmerica, an international network of accounting and consulting firms, they specialize in serving privately held for-profit and not-for-profit businesses and organizations. Through accomplished staff, specialized industry knowledge and extensive technical support, MBK provides clients with not only financial expertise, but with creative solutions to the broader business issues that will shape their future. Visit www.mbkcpa.com for more information.

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: