You may be a business owner that is looking to expand into a new market, purchase new equipment, or conduct development on a new product or design but don't want to use cash from operations. How do you complete this? One of the most common ways to fund these kinds of ventures is through financing, specifically debt financing. To effectively use debt, you need to understand covenants, which may be included in the loan agreement.

What You Need to Know About Bank Covenants

This article will help you understand:

- What are covenants and why are they required

- How covenants might affect your business

- Managing your covenants

Using debt can be an effective way to expand your business, and by understanding the intricacies of bank covenants, you can make better decisions as a business owner

What are covenants? Why do you need covenants?

Simply put, a covenant is a restriction. When a bank or financial institution underwrites a loan or issues a line of credit to a business, they take on a certain amount of risk.

- How likely is the business going to pay timely?

- Will the business pay back the loan?

- How volatile is the company's industry?

- What is the collateral for the potential loan?

These are all questions lenders will ask and need to understand before issuing a loan. To protect their investment, the financing may require financial covenants. First, there are positive covenants, for example you are required to have up to date insurance coverage and meet certain ratios. It might sound odd to call these positive, but these are items the bank wants to ensure you have in place to help protect the business.

Negative covenants act in the opposite way. Often times, the bank does not want the Company taking on other debt obligations, without the Bank prior approval or until the most recent debt is paid off. In addition, negative covenants are often structured to look at a Company's solvency and not violating financial metrics. These are built into the financing to protect the bank, but also to protect the Company and the business owner.

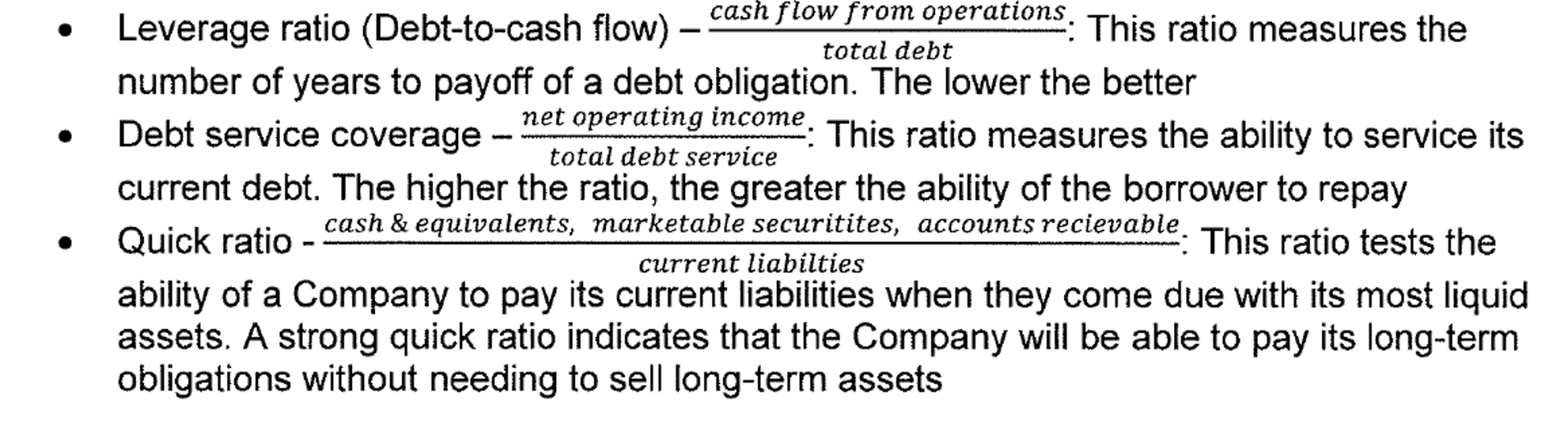

Some of the most common financial ratios and metrics that banks look at for assessing a loan are-

How covenants might affect your business

So you have met with a lender, gone through the approval process and have your new loan right in front of you. Are you ready to sign it? Make sure you review any financing agreements or amendments with your attorney and accountant. Depending on the type of loan, it could require a compilation, review or audit level financial prepared by a CPA. Financial-preparation ranges in complexity, the more complex, the more intrusive, and costly. Going from a review level

financial statement to audited financial statements could double your accounting fees that you already pay. This could come as an unwanted surprise if you are not ready for it.

There are changes on the horizon. As bankers look at new loan agreements or new amendments to current loans, be aware do the adoption of the new Accounting Lease standard the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2016-02, Leases, as amended by subsequent ASUs. Companies are not required to implement the new standard until years beginning after December 15, 2021 (effective for fiscal years ending December 31, 2022). This new standard could impact the definition or calculation of specific covenants.

Managing your Covenants

Covenants are not something to wait until the end of the year to evaluate and determine the Companies overall position of compliance with the negative and positive covenants. If you find yourself in a situation of continuously failing your covenants, your overall relationship with a bank might be impacted. To help alleviate this, a Company should conduct tax planning and/or obtaining advice during the year.

Debt is a great tool in a business owner's toolbelt to grow their business. By understanding the restrictions, or covenants that a lender might use, you can make a more informed decision about if debt financing is right for you. You also might use a professional to plan around your new debt to foster a healthy relationship with the bank. Strong creditors lead to happy lenders, which leads to better business for everyone.

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: