MBK Works to "Stuff the Bus" with United Way

MBK Works to "Stuff the Bus" with United Way of Pioneer Valley

The United Way of Pioneer Valley works annually with local partners to collect donations to provide backpacks and school supplies to students who are homeless in our region.

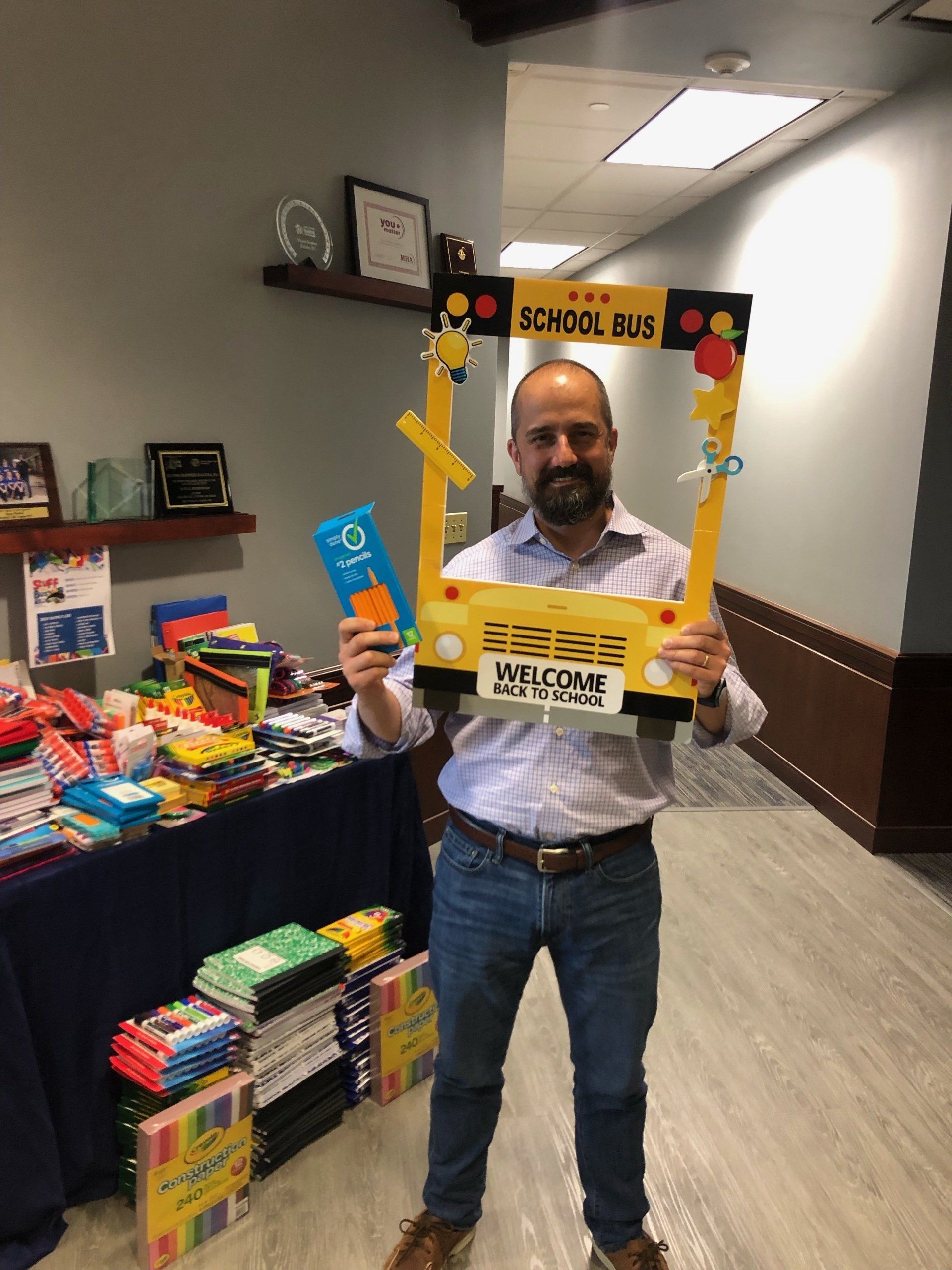

For the 2021/2022 school year, the organization anticipates donating around 1400 backpacks to students in Hampden county. Team Leaders Matt Nash, Eric Pinsoneault and Chelsea Russell led the charge by organizing a supply drive to collect school supplies from the United Way's list. The team at MBK donated 5 boxes filled with school supplies including folders, notebooks, crayons, glue sticks, pencils, pens, erasers, pencil sharpeners, rulers, pencil boxes and cases, 3 ring binders, loose leaf paper, composition books, highlighters, index cards and post-it-notes. Team MBK is grateful to give back to the community and wishes all of the students a wonderful school year.

The United Way is still accepting donations of school supplies for the backpacks, and they can be provided at these locations:

Our main office:

1441 Main Street, Suite 147, Springfield, MA 01103

Chicopee Cupboard:

32 Center Street, Chicopee, MA 01013

Tuesdays & Thursdays, 11am-1pm

Wednesdays, 4-6pm

For more information on Stuff the Bus, contact:

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Share Post: