MBK Proudly Announces Successful Peer Review Acceptance by the Massachusetts Peer Review Committee

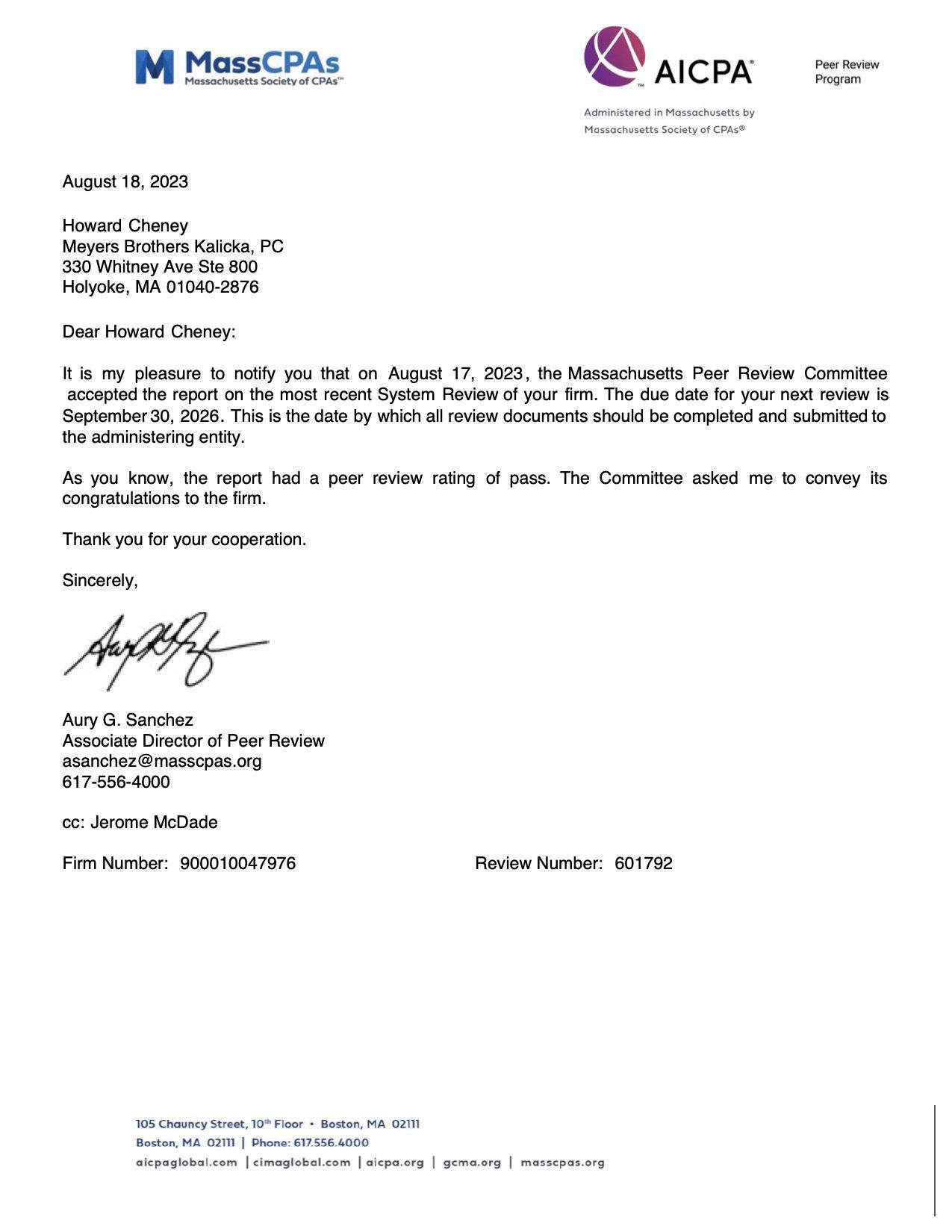

Meyers Brothers Kalicka P.C. (MBK) is pleased to share that the Massachusetts Peer Review Committee has accepted the report on our most recent System Review. This accomplishment underscores our commitment to upholding the highest standards of excellence and quality for the assurance services we provide. The acceptance of our peer review report is a testament to the dedication and hard work of our team, and we are excited to detail the significance of this achievement.

Peer Review: A Mark of Professionalism

Peer reviews are an integral part of the accounting profession, serving as a rigorous evaluation process that assesses the quality of an accounting firm's practices and procedures. These reviews are conducted by independent, qualified individuals or firms who are peers within the profession. The primary goal of a peer review is to ensure that the accounting firm is adhering to professional standards and guidelines while maintaining a high level of quality control.

MBK's Commitment to Excellence

At MBK, we have always placed a premium on excellence, ethics, and professionalism. Our commitment to delivering top-notch accounting and financial services is unwavering. The successful acceptance of our peer review report by the Massachusetts Peer Review Committee reaffirms our dedication to these core values.

Key Benefits of Peer Review Acceptance

- Credibility: Acceptance of our peer review report by the Massachusetts Peer Review Committee enhances our firm's credibility. Clients, partners, and stakeholders can rely on the fact that our practices meet or exceed industry standards.

- Quality Assurance: Peer reviews act as a continuous improvement tool. They help us identify areas where we excel and areas where we can enhance our services, ensuring that our clients receive the best possible support.

- Competitive Edge: Successfully passing a peer review sets us apart from competitors. It highlights our dedication to excellence and can attract clients seeking a trustworthy and reliable accounting partner.

The Road Ahead

This achievement reflects our dedication to professionalism, quality, and client satisfaction. As we look to the future, we remain committed to upholding these values and providing the highest level of service to our clients, partners, and the community.

This material is generic in nature. Before relying on the material in any important matter, users should note date of publication and carefully evaluate its accuracy, currency, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances.

Subscribe to Our Newsletter

Receive a digest of articles published by our thought leaders in your inbox.

Subscribe to Get Our Special Offers

Thanks for subscribing. You'll be the first to hear about new items and special offers.

Please try again later.

Resources

Meyers Brothers Kalicka, P.C. | Privacy Policy