By: Shannon Shainwald

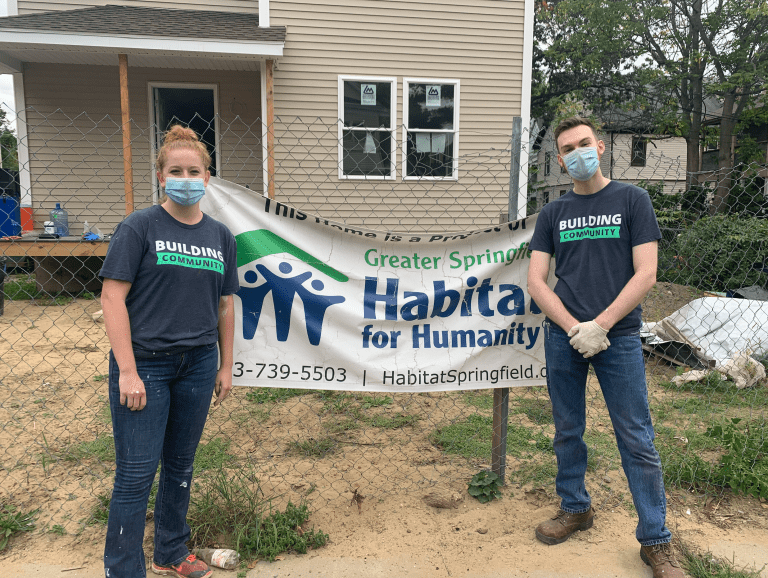

Each year as Thanksgiving passes, followed by the gift-buying frenzy of Black Friday and Cyber Monday, we are reminded to leave some room in our giving for those in our community who need an extra helping hand on Giving Tuesday. Charitable giving is imperative to our strength as a community. Whether it is with financial donations, donations of goods, or volunteering, giving back helps everyone. By sharing resources, knowledge, and time, we help create positive change that continues to feed back into the safety and well-being of every person living and working around us.